Episode 2 - Navigating Uncertainty

The Impact of Economic Volatility on businesses

Episode 2 - Navigating Uncertainty

The Impact of Economic Volatility on businesses

Hello there, and welcome to Episode 2 of "Navigating Uncertainty". In this article, we are going to explore:

Get to know what Economic Uncertainty

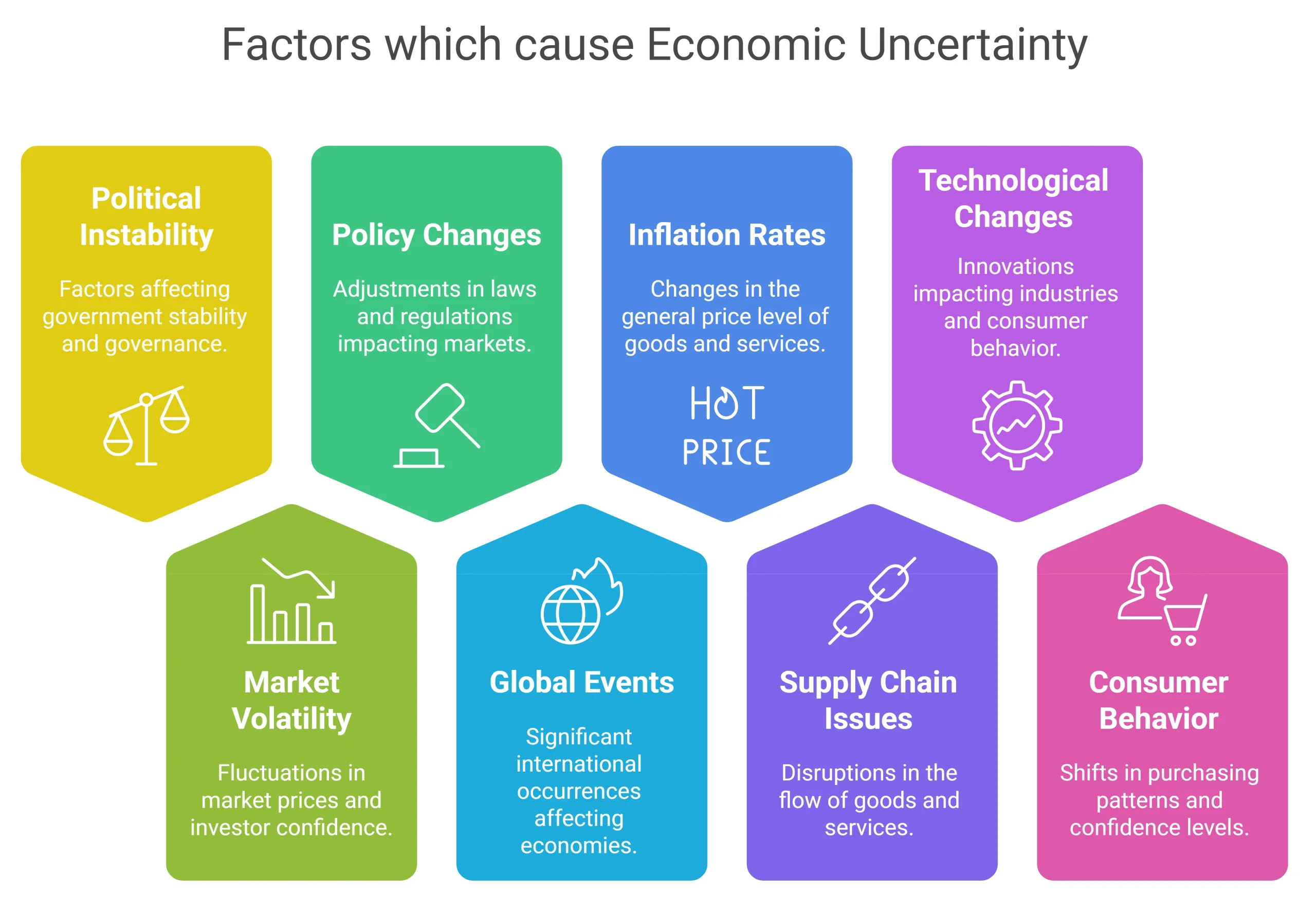

What are the causes of Economic Uncertainty?

What is the Direct Impact on Businesses?

What is the Indirect Impact on Businesses?

Strategies for Mitigating Risks

When we look at the global economy, 'economic volatility' is becoming the 'new normal' for businesses because unpredictable changes in market conditions, inflation, and global crises leading to widespread uncertainty.

The Global Economic Policy Uncertainty Indexhas tripled since the '2008 Financial Crisis', reflecting the growing uncertainty in global economic policies, driven by events such as the US-China trade war, Brexit and the Covid-19 pandemic [1]

'Economic Uncertainty' is often referred to as the rapid and unpredictable changes in the economy which affect key economic factors including inflation, interest rates, exchange rates, and consumer demand. These fluctuations create an unstable environment for businesses, making planning and forecasting more difficult.

In this episode, we'll be exploring the causes of economic volatility, its impact on businesses, and strategies to navigate it effectively.

1.1 The Causes of Economic Volatility

When we look at 'Economic Volatility', there are several causes which contribute to it. These include:

Global Events and Crises - When businesses are unsure of the future, they may delay or reduce their investments in new projects, technology, or expansion. As companies prefer to hold on to their cash reserves rather than take on new risks, this cautious approach can slow down growth and innovation.

Inflation and Deflation -Economic uncertainty often leads to volatility in financial markets, which can cause sudden changes in consumer demand. This creates an effect where business experience unpredictable revenue streams, making it harder to plan and budget effectively.

Monetary Policy and Interest Rates - Business will experience increased costs due to inflation, rising interest rates, or supply chain disruptions. This can reduce profit margins, forcing companies to find ways to cut expenses which often include layoffs or scaling back operations.

- Exchange Rate Fluctuations - When businesses are unsure of the future, they may delay or reduce their investments in new projects, technology, or expansion. As companies prefer to hold on to their cash reserves rather than take on new risks, this cautious approach can slow down growth and innovation.

- Trade Policies and Tariffs -Economic uncertainty often leads to volatility in financial markets, which can cause sudden changes in consumer demand. This creates an effect where business experience unpredictable revenue streams, making it harder to plan and budget effectively.

- Stock Market Fluctuations - Business will experience increased costs due to inflation, rising interest rates, or supply chain disruptions. This can reduce profit margins, forcing companies to find ways to cut expenses which often include layoffs or scaling back operations.

Political Instability - When businesses are unsure of the future, they may delay or reduce their investments in new projects, technology, or expansion. As companies prefer to hold on to their cash reserves rather than take on new risks, this cautious approach can slow down growth and innovation.

Technological Disruptions -Economic uncertainty often leads to volatility in financial markets, which can cause sudden changes in consumer demand. This creates an effect where business experience unpredictable revenue streams, making it harder to plan and budget effectively.

Natural Disasters and Climate Change - Business will experience increased costs due to inflation, rising interest rates, or supply chain disruptions. This can reduce profit margins, forcing companies to find ways to cut expenses which often include layoffs or scaling back operations.

Consumer Confidence - When businesses are unsure of the future, they may delay or reduce their investments in new projects, technology, or expansion. As companies prefer to hold on to their cash reserves rather than take on new risks, this cautious approach can slow down growth and innovation

When we look at the global economy, 'economic volatility' is becoming the 'new normal' for businesses because unpredictable changes in market conditions, inflation, and global crises leading to widespread uncertainty.

1.1 The Impact of Economic Volatility on Businesses

When we look at 'Economic Volatility', there are several causes which contribute to it. These include:

Global Events and Crises - Global events such as pandemic, natural disasters, or geopolitical conflicts can create significant economic instability as these events often disrupt trade, supply chains, and demand, leading in uncertainty in markets. For example, the Covid-19 pandemic caused an unprecedented economic contraction globally by 3.2% and the loss of economic output by around 8.5 trillion USD, leading to GDP declines in countries, unemployment spikes, and disruptions across many industries [2].

Inflation and Deflation -Economic uncertainty often leads to volatility in financial markets, which can cause sudden changes in consumer demand. This creates an effect where business experience unpredictable revenue streams, making it harder to plan and budget effectively.

Monetary Policy and Interest Rates - Business will experience increased costs due to inflation, rising interest rates, or supply chain disruptions. This can reduce profit margins, forcing companies to find ways to cut expenses which often include layoffs or scaling back operations.

Global Events and Crises - When businesses are unsure of the future, they may delay or reduce their investments in new projects, technology, or expansion. As companies prefer to hold on to their cash reserves rather than take on new risks, this cautious approach can slow down growth and innovation.

Inflation and Deflation -Economic uncertainty often leads to volatility in financial markets, which can cause sudden changes in consumer demand. This creates an effect where business experience unpredictable revenue streams, making it harder to plan and budget effectively.

Monetary Policy and Interest Rates - Business will experience increased costs due to inflation, rising interest rates, or supply chain disruptions. This can reduce profit margins, forcing companies to find ways to cut expenses which often include layoffs or scaling back operations.

[1] Economic Policy Uncertainty Index - https://www.policyuncertainty.com

[2] World Economic Outlook - International Monetary Fund (IMF) - https://www.imf.org/en/Publications/WEO

[3] COVID-19 to slash global economic output by $8.5 trillion over next two years - United Nations - https://www.un.org/en/desa/covid-19-slash-global-economic-output-85-trillion-over-next-two-years